property tax forgiveness pa

The amount of tax that is eligible to be forgiven depends on their filing status the income level for the year and the number of dependent children you have if any. Properties owned by Non-Bahamians shall be entitled to a waiver of all surcharges payable on outstanding taxes which have been outstanding for more than 180 days provided.

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax Penalty Forgiveness Posted on December 8 2020 The penalty for real estate taxes was forgiven through November 30 2020.

. Learn how to deduct your PA ABLE contributions on PA income taxes. Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing. The program provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has a financial need.

Pennsylvanians who are approved for a rebate on property taxes or rent paid in 2021 will receive an additional one-time bonus rebate later this year. Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts. Learn how to deduct your PA ABLE contributions on PA income taxes.

Code 524 relating to processing applications. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Tax Forgiveness is determined based on marital status family size and eligibility income.

Being a homeowner in Pennsylvania can qualify you for another property tax relief. Application forms for the Property TaxRent Rebate Program are now available for eligible Pennsylvanians to begin claiming rebates on. Ad The Leading Online Publisher of National and State-specific Small Business Legal Docs.

Philadelphia Scranton or Pittsburgh senior households with incomes of less than 30000 can get an increase in their property tax rebate by 50 Senior households from other parts of. Record tax paid to other states or countries. In Part D calculate the amount of your Tax Forgiveness.

Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system. The one-time bonus rebate will be equal to. Record the your PA tax liability from Line 12 of your PA-40.

Ad Look For Pa Property Tax Relief Now. A The veteran or the unmarried surviving spouse shall request the following two forms from the County Director of Veterans Affairs or the Bureau for Veterans Affairs Fort Indiantown Gap. If you are filing as Unmarried use Table 1.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return.

This is the first time in. If you are filing as Married use Table 2. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Move down the left-hand side of the table until you come to the number of dependent children you may claim. Insurance proceeds and inheritances- Include the total proceeds received from life or. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP.

The Tax Relief Program began in 1973 as a result of the 1972 Question 3 constitutional amendment. Find Everything about Pa property tax relief and Start Saving Now. Ad No Money To Pay IRS Back Tax.

Ad Apply For Tax Forgiveness and get help through the process. Provides a reduction in tax. The level of tax forgiveness is based on the income of the taxpayer and.

The homeowner will need to. Taxes paid in December will now be.

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

After You Win The Lottery Hire A Taxlawyerlosangeles You Are Not A Tax Lawyer Or An Accountant After Winning It Irs Taxes Tax Attorney Debt Relief Programs

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

Getting Ready To Sell A Property In Pennsylvania Call Jennifer The Sellers Property Disclosure Is Real Estate Forms Real Estate License Agency

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies

Property Tax Elimination In Pa Facebook

Deducting Property Taxes H R Block

Which States Have The Lowest Property Taxes

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

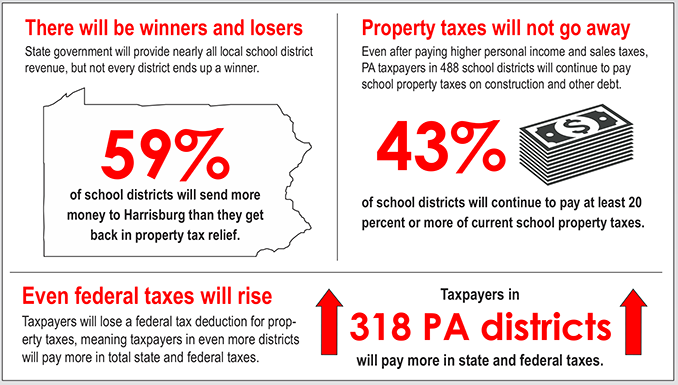

Property Tax Bill Will Cost Pa Taxpayers More

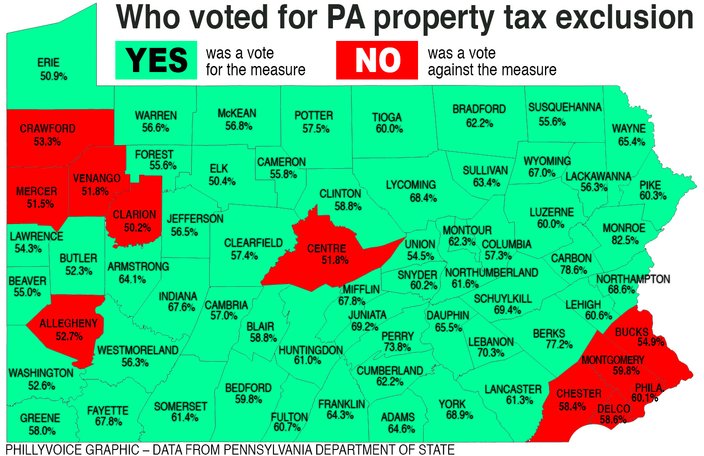

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice